Historical Context and Trends

The 2025 Social Security COLA increase is a significant event for millions of Americans who rely on these benefits. Understanding the historical context and trends surrounding COLA adjustments is crucial to appreciating the impact of this year’s increase.

The COLA is designed to protect the purchasing power of Social Security benefits against inflation. However, the amount of the increase varies each year, depending on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Historical COLA Increases

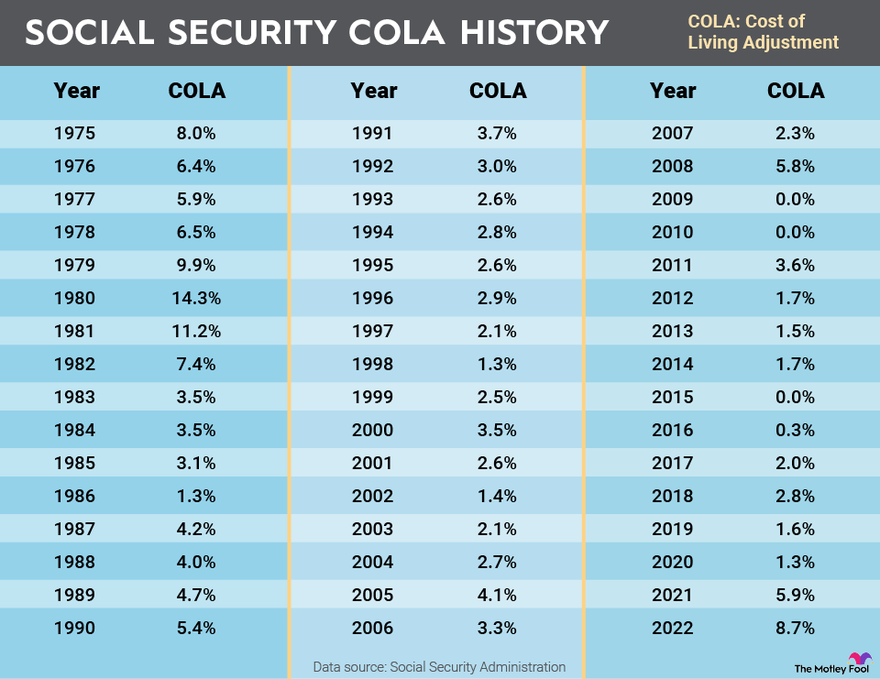

The following table shows the COLA increases for the past decade:

| Year | COLA Increase (%) |

|---|---|

| 2015 | 1.7% |

| 2016 | 0.3% |

| 2017 | 0.3% |

| 2018 | 2.0% |

| 2019 | 2.8% |

| 2020 | 1.6% |

| 2021 | 1.3% |

| 2022 | 5.9% |

| 2023 | 8.7% |

| 2024 | 3.2% |

This data illustrates the variability of COLA increases, with some years seeing significant adjustments and others experiencing minimal or even no increases.

Trends in Social Security COLA Increases

Analyzing historical data reveals several trends in Social Security COLA increases:

* Inflationary Periods: During periods of high inflation, COLA increases tend to be larger to compensate for the erosion of purchasing power. For example, the 2023 COLA increase of 8.7% reflected the highest inflation in decades.

* Low Inflation: Conversely, when inflation is low, COLA increases are often smaller or even nonexistent. This was evident in the years 2016 and 2017, when COLA increases were only 0.3%.

* Long-Term Impact: Over the long term, COLA increases have generally kept pace with inflation, although there have been periods where benefits have fallen behind.

Impact of COLA Increases on Beneficiaries’ Purchasing Power

The impact of COLA increases on beneficiaries’ purchasing power is a complex issue. While COLA adjustments are designed to maintain the real value of benefits, various factors can influence their effectiveness.

* Cost of Living Variations: The cost of living can vary significantly across different regions and demographic groups. COLA increases may not fully compensate for rising costs in certain areas or for specific needs, such as healthcare.

* Other Income Sources: For beneficiaries who rely heavily on Social Security income, COLA increases can provide crucial support. However, for those with other income sources, the impact of COLA adjustments may be less pronounced.

* Economic Conditions: Overall economic conditions can influence the purchasing power of benefits. During periods of economic recession, even with COLA increases, beneficiaries may experience a decline in their real income.

The impact of COLA increases on beneficiaries’ purchasing power is a complex issue that depends on various factors, including inflation, cost of living, and overall economic conditions.

Implications and Considerations: 2025 Social Security Cola Increase

The 2025 Social Security Cost-of-Living Adjustment (COLA) increase, while intended to help beneficiaries maintain their living standards, carries potential economic and social implications that require careful consideration. The increase can impact various aspects of the economy and society, affecting both beneficiaries and the broader population.

Economic Implications of the COLA Increase

The COLA increase can have a significant impact on the economy, influencing factors such as consumer spending, inflation, and government spending.

- Increased Consumer Spending: A larger COLA can lead to increased spending by beneficiaries, stimulating economic activity and potentially contributing to inflation. This increased spending can benefit businesses, especially those serving the elderly population.

- Inflationary Pressures: The COLA increase itself can contribute to inflationary pressures, as businesses may raise prices to offset the increased costs of labor and materials. This could lead to a cycle of rising prices and wages, potentially eroding the real value of the COLA increase over time.

- Government Spending: A higher COLA means increased outlays for the Social Security program, impacting government budgets and potentially leading to higher taxes or cuts in other government programs.

Social Implications of the COLA Increase, 2025 social security cola increase

The COLA increase can also have social implications, affecting the well-being and quality of life of beneficiaries and the broader society.

- Improved Living Standards: The COLA increase can help beneficiaries maintain their living standards, ensuring they can afford basic necessities such as food, housing, and healthcare. This can improve their overall well-being and quality of life.

- Reduced Poverty: The COLA increase can help reduce poverty among the elderly, particularly those living on fixed incomes. This can have a positive impact on social cohesion and reduce the burden on social safety nets.

- Equity and Fairness: The COLA increase ensures that beneficiaries receive a fair adjustment to their benefits, reflecting the rising cost of living. This contributes to a more equitable society, ensuring that the elderly are not disproportionately affected by inflation.

Challenges in Managing Finances with the COLA Adjustment

While the COLA increase aims to mitigate the impact of inflation, beneficiaries still face challenges in managing their finances effectively.

- Rising Healthcare Costs: Despite the COLA increase, healthcare costs continue to rise faster than inflation, putting a strain on beneficiaries’ budgets. Many beneficiaries struggle to afford essential healthcare services, even with the increased benefits.

- Limited Savings and Investments: Many beneficiaries have limited savings and investment opportunities, making it difficult to offset the impact of inflation on their purchasing power. The COLA increase may not fully compensate for the erosion of their savings due to rising prices.

- Unexpected Expenses: Beneficiaries can face unexpected expenses, such as home repairs or medical emergencies, which can significantly impact their finances. The COLA increase may not be sufficient to cover these unexpected costs, leading to financial hardship.

Strategies for Maximizing the Benefits of the COLA Increase

Beneficiaries can adopt various strategies to maximize the benefits of the COLA increase and manage their finances effectively.

- Budgeting and Financial Planning: Creating a realistic budget and planning for future expenses can help beneficiaries manage their finances effectively and ensure they can afford essential needs. This can involve tracking income and expenses, identifying areas where spending can be reduced, and setting financial goals.

- Seeking Financial Assistance: Beneficiaries can explore various financial assistance programs available to them, such as government subsidies, tax credits, and community resources. These programs can provide additional support and help offset the impact of rising costs.

- Investing Wisely: While beneficiaries may have limited savings, they can consider investing in low-risk options such as government bonds or certificates of deposit. These investments can provide a modest return and help protect their savings from inflation.

With the 2025 Social Security COLA increase, maybe you’ll have some extra cash to spruce up your living room! A fresh coat of paint or a new wing chair cover pattern can make a big difference. Whatever you choose, remember to enjoy the extra bit of money and make your home feel even more special.

The 2025 Social Security cost-of-living adjustment (COLA) is a hot topic, and while we wait for the official announcement, let’s take a break and admire the timeless elegance of a canton chair and table. Their intricate details and craftsmanship are a reminder that quality and longevity are always worth the wait, just like a generous COLA increase!